- Products

- RegLab for ...

- Knowledge centre

Download the AML whitepaper >

Discover the key steps to comply with AML, especially for everyone who must meet AML requirements

Discover the key steps to comply with AML, especially for everyone who must meet AML requirements - The company

Working at RegLab >

There may not be any vacancies that perfectly match your profile, but that does not mean there is no room for someone who can improve RegLab.

- Book a demo

Automated AML compliance and client onboarding for firms that take integrity seriously.

RegLab helps offices to be 100% compliant without disappointment.

Thanks to automated, client-friendly workflows, no AML check is skipped.

Clients, employees and supervisors are equally happy.

For lawyers —

Comply with AML easily without disrupting your client relationship

As a busy professional, you most probably prefer to spend as little time as possible on secondary issues like AML.

For tax advisors —

AML-compliance without any time-consuming work processes

Complying with AML requirements is a challenging and time-consuming task. How do you go about making things easy for yourself?

For investment funds —

Fulfill all compliance obligations and save valuable time

Comply with AML without hassle and easily keep all investor data up-to-date.

Comply in less time and with a big smile? It's possible.

With RegLab's software and additional compliance service, today every office meets the AML requirements. The AML work process and client onboarding are fully automated. The result is this: a streamlined working method for every professional who takes compliant work seriously. It allows you to bring in clients with more ease and with more pleasure. You have time for other things, avoiding high fines at the same time.

Knowledge Centre

The RegLab Knowledge Centre is the place to go for white papers, customer stories and blogs.

Find out everything there is to know about the AML, UBO, PEP and sanction lists.

These firms rely on RegLab

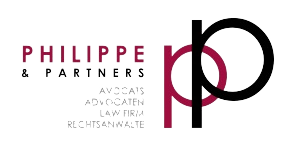

Speed up client acceptance

Clients receive and approve digital engagement letters, general terms and conditions, and privacy statements.

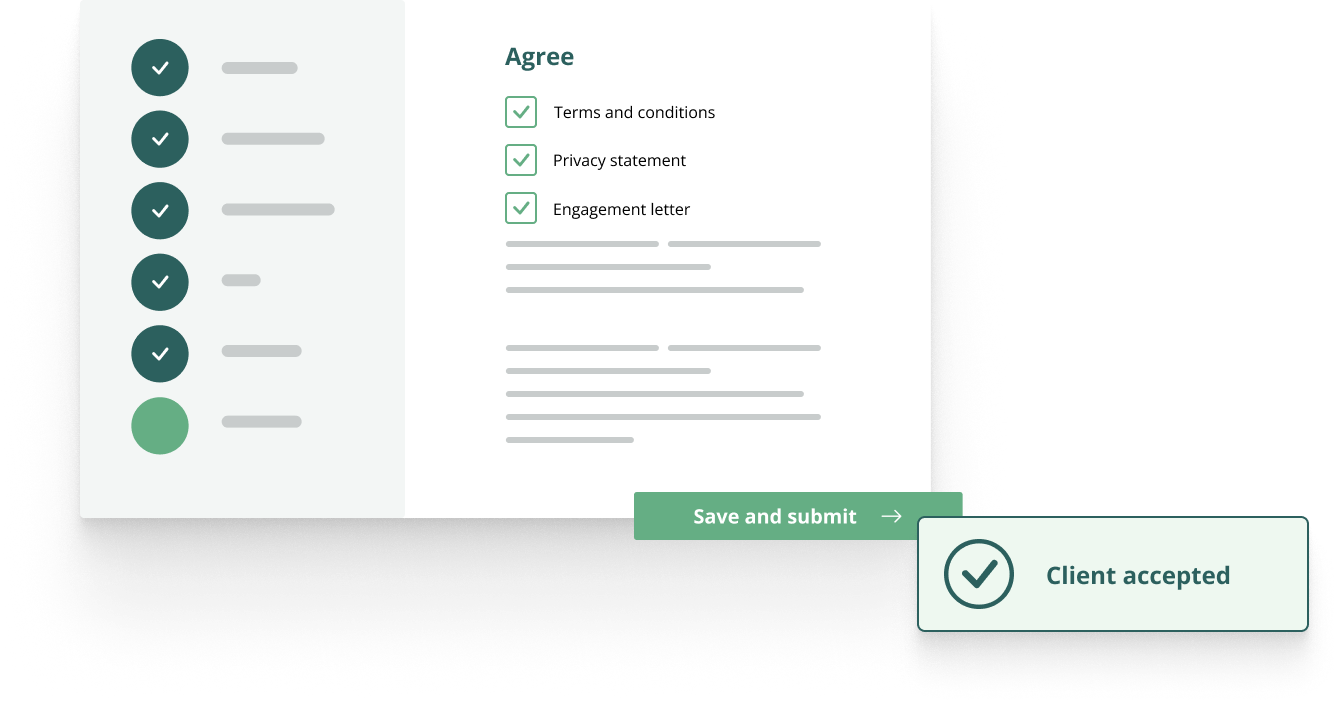

Record the file information easily

RegLab gives you the tools to easily involve clients in the identification and recording of persons, representatives, UBOs, PEPs, corporate structures and the origin of resources.

Check, approve and create an audit trail

RegLab takes care of the recording and audit trail of all compliance steps taken. As a result, you fully meet all AML requirements. You can be sure to be well prepared for the supervisor’s visit.

We make compliance perfectly easy

AML

RegLab's AML module is more than a straightforward 'check the box'. It is a fully thought-out workflow, which ensures that you

are 100% compliant.

It ensures the identification and verification of clients and the recognition of unusual transactions. You adhere entirely to the latest guidelines and are prepared for an audit.

Non-AML

RegLab takes care of the identification and mandatory recording according to the guidelines for lawyers.

With the non-AML module of RegLab, you have a real-time overview of the number of non-AML cases compared to the AML cases.

Find out what RegLab can do for your office

One step ahead

Regulations are subject to change. It is therefore quite a challenge to continuously comply with the guidelines for compliant work. This will undoubtedly not diminish in the coming years. RegLab provides an automated process that fits your working method. A workflow that is constantly updated according to new guidelines. With RegLab, you are always one step ahead of legislation. That is what smart, future-oriented and carefree entrepreneurship is all about.

Testimonial —

Atlas Tax Lawyers / Fiscalisten

“RegLab has helped us to streamline our procedures”

— Read more

Testimonial —

Banning Lawyers / Advocaten

'RegLab has enabled us to ensure that many files that were non-compliant are now compliant.'

— Read more

.png)