- Products

- RegLab for ...

- Knowledge centre

Download the AML whitepaper >

Discover the key steps to comply with AML, especially for everyone who must meet AML requirements

Discover the key steps to comply with AML, especially for everyone who must meet AML requirements - The company

Working at RegLab >

There may not be any vacancies that perfectly match your profile, but that does not mean there is no room for someone who can improve RegLab.

- Book a demo

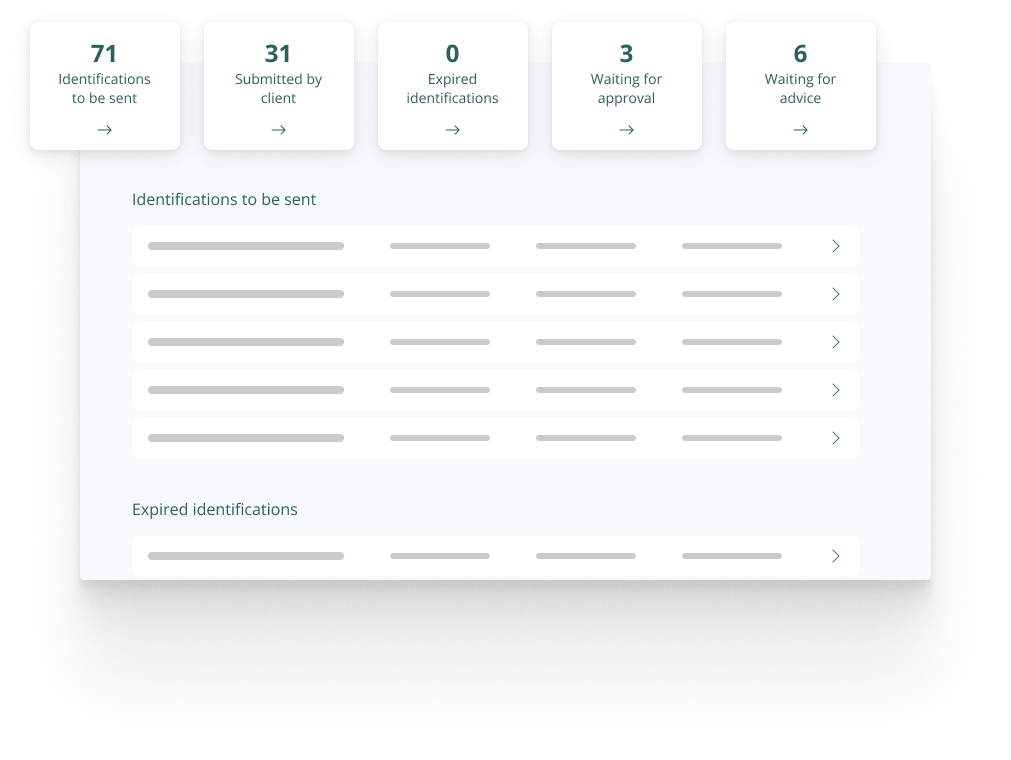

The RegLab application

With RegLab's software and additional compliance service, every office meets the AML and Voda requirements. The AML work process is fully automated. This also applies to the client onboarding process. The result is this: a streamlined working method for every professional who takes compliant work seriously. It allows you to bring in clients with more ease and with more pleasure, avoid high fines at the same time.

Easy compliance with laws and regulations

Being compliant: it's easier said than done. Employees often find it difficult to implement the open standards from the legislation. RegLab ensures that complying with AML requirements never feels like walking on thin ice. RegLab provides a steady foundation on which you can move forward smoothly.

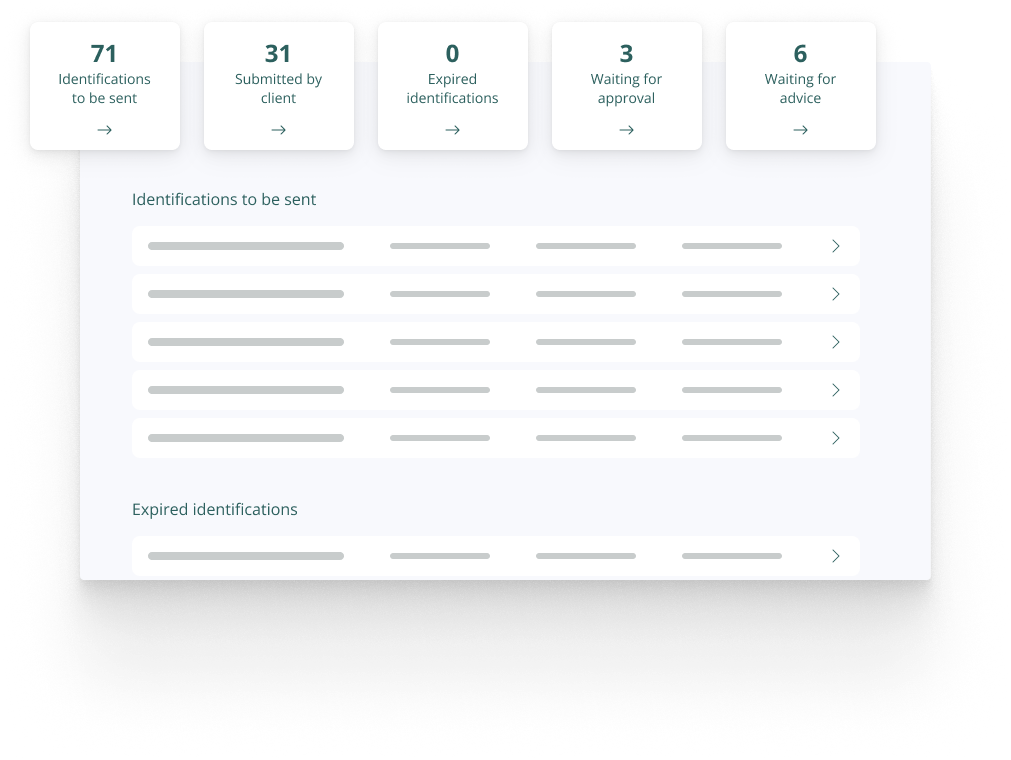

Onboarding Features

Client Interaction

Secure environment

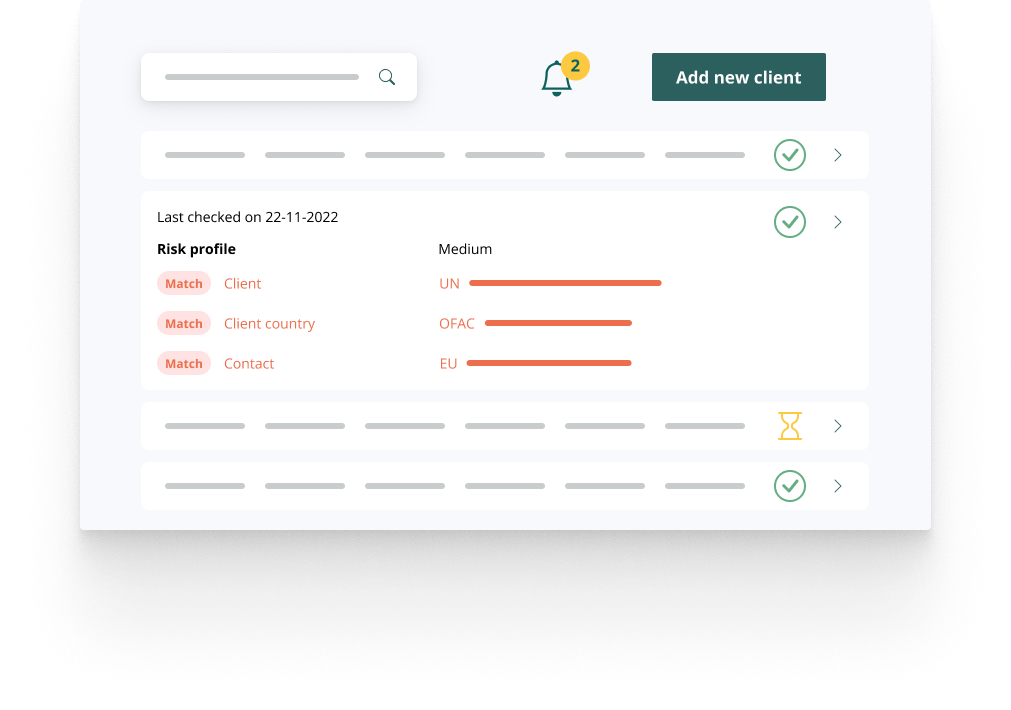

Capture & Investigate Risk Profiles

Risk profiles are automatically identified and continuously monitored. All risk increases, actions and investigations are recorded.

UBO

requirements involving UBO verification.

PEP verification

Origin of funds

funds. RegLab takes this work off your hands, 100% accurately and fully automated.

Integrations

Monitoring Features

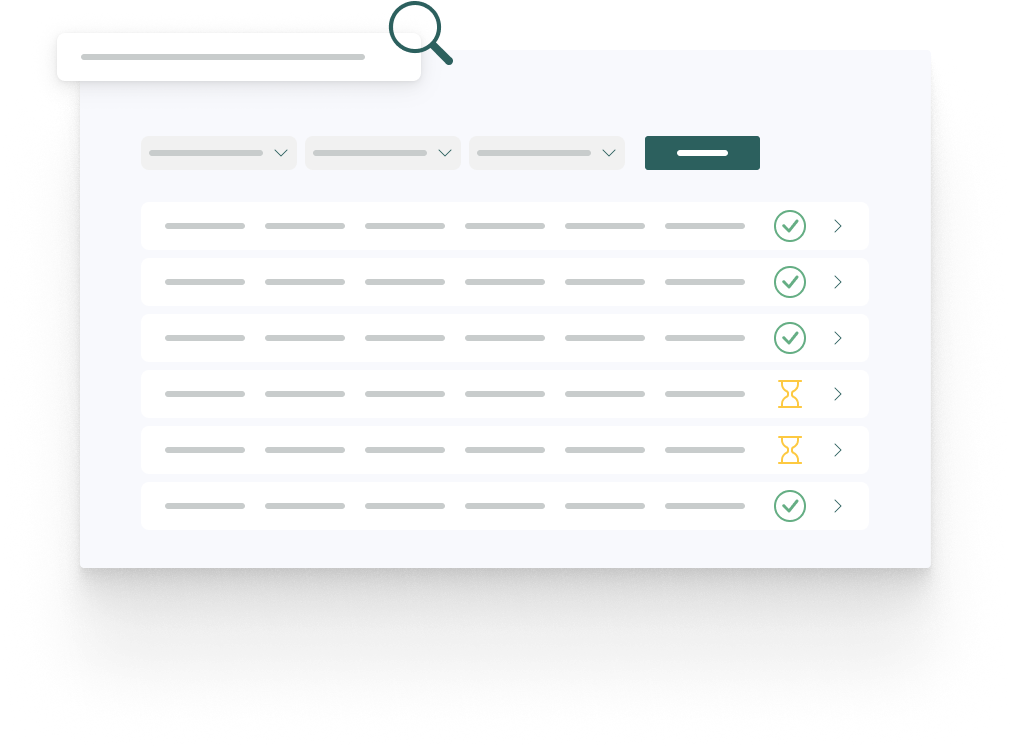

AML module

to ensure that you are 100% compliant.

Non-AML module

real-time overview of the number of non-AML cases compared to AML cases.

Capture & investigate risk profiles

and investigations are recorded.

Management reports

to non-AML) and how many high-risk files are there? From question to answer.

UBO

requirements set to UBO verifications.

Reporting Features

Audit trail

instantly get the latest overview of files and associated evidence.

Overview of files

Monitoring risk profiles

and investigations are recorded.

PEP verification

Report for the supervisor

Capturing Files Features

AML capture

Overview of files

to non-AML) and how many high-risk files are there? From question to answer. Also available in PDF with one click.

Capture & Investigate Risk Profiles

Origin of funds

funds. RegLab takes this work off your hands, 100% accurately and fully automated.

AML compliance service

Implementing an AML policy is not a straightforward process that you 'just add'. What are the guidelines and standards exactly and what is expected of you during an audit? How do you ensure that the AML process is completely in order? What is the best way to make sure the AML does not feel like a necessity to your office, but rather an essential element to work with integrity? Thanks to RegLab’s AML support, you are assured of a sound strategy and implementation. Expect support in terms of policy, but also when it comes to implementation (e.g. reviews, audits, training and full outsourcing). Read more about this professional compliance support. This service is also available to offices not using the AML or compliance software.